Insights on Smart Outsourcing Solutions

Comprehensive Insights, Strategies, and Solutions to Make Smarter Accounting Decisions

Browse topics you care about using category and subcategory filters

Category

Harnessing AI for Predictive Analytics in Corporate Finance

Scenario Planning for Economic Uncertainty: Tools and Techniques

Streamlining Intercompany Eliminations: Close and Consolidation Support with Offshore Global Accounting Teams

Addressing Lease Accounting and Revenue Recognition Challenges Before the Audit

Building a Continuous Accounting Culture: Real-Time Reporting via Outsourced Teams

The CFO’s Checklist for Year-End Contract Renewals With Outsourcing Providers

Navigating GAAP and IFRS Updates for Year-End Reporting

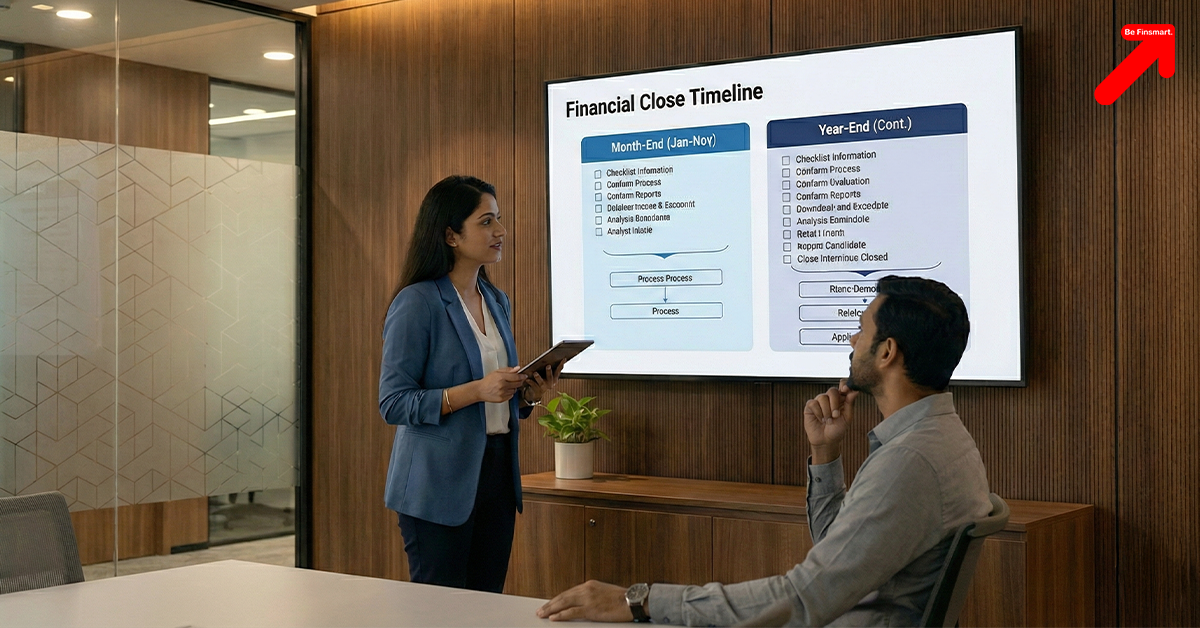

Month-End vs Year-End Close: Tips for Maintaining Momentum in Q4

Why Would Clients Say “Yes” to Your Accounting Firm – The Psychology of It

Finsmart Solutions

CPA & Accounting FIRM

FINSMART

KNOWLEDGE HUB

Listen, Read & Watch