FINSMART SERVICES

CPA & ACCOUNTING FIRM

Deliver accurate, compliant, and efficient tax prep—built for CPA firms that value precision and speed.

The Tax Associate Seat supports your firm with reliable, detail-oriented professionals who handle core tax preparation tasks. From entering client-provided data to preparing supporting forms and tracking progress, these associates ensure your returns are accurate, compliant, and delivered on time. Perfect for firms looking to streamline tax operations and improve turnaround without adding hiring complexity.

SEAT FEATURES

- Pre-trained on leading tax software like UltraTax, Lacerte, Drake, ProConnect, CCH Axcess

- 2 year of tax preparation experience

- Accuracy-focused, deadline-driven, and process-compliant

- Seamless collaboration with your in-house tax team

- Supervised by Finsmart Engagement Manager for quality assurance

SCOPE OF WORK

Scale your tax department with skilled professionals who deliver accuracy, insight, and control.

The Tax Senior Seat brings advanced tax preparation expertise to your firm. Equipped to handle complex filings across multiple entities, these professionals manage detailed workpapers, book-to-tax adjustments, and tax analysis with accuracy and efficiency. They also provide initial reviews, freeing up your senior leadership’s time to focus on high-value advisory and growth.

SEAT FEATURES

- 4+ years of tax experience across U.S. entities

- Proficient in Federal and State returns

- Skilled in handling complex entity structures

- Effective communicator and client coordinator

- Supported by Finsmart Engagement Manager for seamless delivery

SCOPE OF WORK

Lead with confidence—ensure every return is reviewed, compliant, and ready to file.

The Tax Manager Seat brings leadership, quality assurance, and oversight to your tax operations. These senior professionals manage reviews, conduct tax research, and coach your team—ensuring every return meets the highest compliance standards. Acting as your extended leadership arm, they strengthen control, enhance accuracy, and drive consistency across all tax deliverables.

SEAT FEATURES

- 8+ years of experience in U.S. tax preparation and review

- Strong leadership and quality review capabilities

- Deep knowledge of compliance, filing, and workflow optimization

- Client-facing and mentor-oriented approach

- Backed by Senior Tax Advisor support for technical expertise

SCOPE OF WORK

Comparative Table

Finsmart Tax Seat Features and Cost Analysis

Seat Type

Tax Associate Seat

Tax Senior Seat

Tax Manager Seat

Experience Level

Bachelor’s in Accounting with 2+ years of experience

Bachelor’s/Master’s in Accounting with 4+ years of experience

Master’s in Accounting with 8+ years of experience

Monthly Cost (USD)

$3,200

$4,500

$6,000

Core Focus

Accurate data entry, basic tax prep, document tracking

Complex returns, reconciliations, adjustments, initial reviews

Review, leadership, compliance oversight, mentoring

Key Deliverables

Form 1040, 1120S, 1065, FBAR, data checks

Individual, Corporate, Partnership & Nonprofit returns

Return review, tax research, provision checks

Ideal For

Firms seeking cost-effective, reliable tax prep support

Firms scaling tax operations with mid-level expertise

Firms needing leadership-level oversight & process control

Comparative Table

Finsmart Tax Seat Features and Cost Analysis

Tax Associate Seat

Experience Level

Monthly Cost (USD)

Core Focus

Key Deliverables

Ideal For

Tax Senior Seat

Experience Level

Monthly Cost (USD)

Core Focus

Key Deliverables

Ideal For

Tax Manager Seat

Experience Level

Monthly Cost (USD)

Core Focus

Key Deliverables

Ideal For

CPA & Accounting Firms Services

Finsmart Talent. Build your Team.

Finsmart Accounting Seat model delivers pre-trained professionals who integrate effortlessly into your firm, managed by you and working through your tech, email, and communication tools.

Bookkeeping Seat

Get accurate, efficient bookkeeping with certified offshore talent—fully dedicated and embedded into your firm’s workflow.

Sr. Accounting Seat

End-to-end accounting support including month-close, reconciliations, and reports—delivered by experienced professionals embedded in your team.

Reviewer Seat

Free up Partner bandwidth with expert reviewers handling reconciliations, financial reviews, and year-end readiness with precision.

USA Tax Seat

Scale your tax practice without the hiring headache—plug in pre-vetted U.S. tax pros who deliver accuracy, compliance, and speed.

Cleanup Seat

Specialized team for fixing broken books, performing reconciliations, and preparing clean, compliant financial records quickly.

Workflow Seat

Set up or optimize practice workflows and software with experts who bring structure, visibility, and operational efficiency.

Requires CPAs to disclose sensitive end-client details, making the process cumbersome and repetitive every time a new client is added.

Involves hiring FTEs, requiring extensive recruitment efforts, compensation negotiations, and onboarding delays.

At Finsmart Accounting, we have redefined the way CPA and Accounting firms outsource their accounting needs with our groundbreaking Accounting Seat model. Unlike traditional outsourcing approaches that create inefficiencies, delays, and operational complexities, Accounting Seat is an innovative, plug-and-play solution designed to deliver pre-vetted, pre-qualified, and pre-trained accounting professionals who seamlessly integrate with your firm.

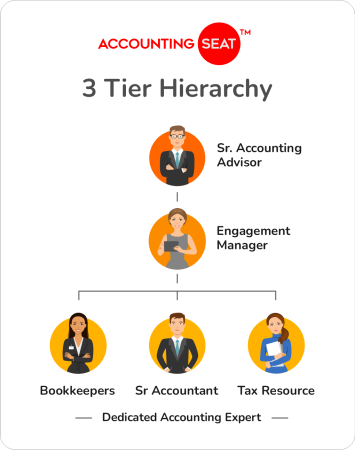

One Subscription. Three Layers of Expertise.

When you sign up for Accounting Seat, you’re not just getting a single resource—you’re unlocking a three-layered powerhouse team designed to drive efficiency, accuracy, and success in your accounting operations.

A Dedicated Account Manager who handles daily accounting tasks as an extension of your team, an Engagement Manager who oversees onboarding, engagement performance, and delivery to ensure success, and a Senior Accounting Advisor who steps in as needed to provide expert guidance on complex matters and technical oversight—all included in your subscription.

This 3-tier team structure ensures that whether you’re looking to scale, optimize workflows, or gain senior-level expertise, you have the right professionals backing you – all included in your subscription, with no hidden costs.

Accounting Seat – Model Advantages

Plug-n-Play Model

Instantly deploy trained accountants -no hiring, no onboarding delays.

English-Speaking Talent

Fluent communication for smooth coordination with your onshore team.

Certified in QBO, Xero & More

Work with accountants certified in leading global platforms and tools.

Tech-Savvy Accountants

Adaptable professionals who understand accounting tech and automation.

Your Team, Managed by You

Fully dedicated resources that function like your in-house staff—under your direction.

Hassle-Free Resource Replacement

Backed by a strong bench—seamless transitions with no retraining cost.

5 Easy Onboarding Steps

Once the agreement is signed, your Finsmart team will be

up and running within 7 days, following these 5 simple steps.

1. Talent Assigned.

Finsmart’s ready plug-and-play model lets you onboard pre-vetted talent and begin training immediately.

2. Client Process Training

The assigned team undergoes client process training, which you only need to do once. We’ll document it for future talent training.

3. Test Run Projects

The team will conduct a mock session on your projects to ensure work effectiveness and efficiency.

4. Review Test Projects

Customer and Finsmart team together reviews the project tests to bring more efficiency.

5. Team Goes LIVE!

Once the customer is satisfied, the team goes LIVE, and you can manage them as your in-house team.

Scale Smart.

Grow Fast.

Unlock accounting capacity with plug-and-play offshore teams—no hiring, no hassle, just results.

Accelerate your growth.

Get Started today.

FAQs

A Tax Seat provides you with a dedicated, trained tax professional who functions as a seamless extension of your in-house team. This full-time resource directly accesses your systems (via secure RDP/cloud) and performs all the preparation, and compliance tasks your remote employee would, instantly resolving your capacity bottlenecks during peak season and beyond.

Our tax professionals are trained and proficient in all major U.S. tax software suites, including UltraTax, ProConnect, ProSeries, CCH Axcess Tax, Lacerte, and more. Since they work directly within your firm’s secure systems, there is zero learning curve regarding new software or platform migration.

Every dedicated tax professional undergoes rigorous, continuous training focused exclusively on U.S. tax code, GAAP standards, and the latest IRS regulations. This includes annual updates before tax season. Our resources typically hold a relevant degree and possess significant hands-on experience in preparing various U.S. returns (1040, 1120, 1065, etc.).

Our streamlined process is designed for rapid deployment. Once the contract is finalized, we can typically have a fully-vetted and system-ready tax professional onboarded and working within 2 to 3 weeks*. This involves final skill verification, security setup, and a brief orientation to your specific firm’s workflow and communication channels.

Our Tax Seat is offered on a fixed monthly fee basis, providing you with transparent and predictable costs. This model is significantly more cost-effective than hiring an equivalent in-house resource, as it eliminates overhead like recruitment fees, benefits, payroll taxes, and office space, allowing you to convert a variable cost (salaries/overtime) into a fixed, budget-friendly expense.

Our dedicated model is designed to align with your firm’s schedule. Our professionals use your preferred tools (Slack, Microsoft Teams, email, Zoom) and are available during mutually agreed-upon core hours to overlap with your business day.

Our Tax Seat professionals are trained across a comprehensive range of U.S. tax forms. They are proficient in preparing Individual (1040), Corporate (1120/1120-S), Partnership (1065), Non-Profit (990), and Fiduciary (1041) returns, in addition to state and local filings.

Yes. Scalability is a cornerstone of our Tax Seat model. We maintain a ready bench of pre-vetted, trained tax professionals, providing the flexible capacity necessary to manage unexpected growth or peak season demands efficiently.