The way today’s workforce perceives their workplaces and jobs has changed over the years. Earlier, one of the key reasons why someone would join the accounting profession had more to do with stability. However, they were ready to put in the extra hours and were okay with the low pay. This has changed with millennials and Gen-Z becoming a major part of the workforce. Today’s workforce isn’t just looking for stability; they are looking for work-life balance, pay parity, and justification for the long hours they might be expected to put in.

One key reason fewer accountants are willing to join the accounting profession is the poor job distribution. And a top factor resulting in this is the lack of specialized skills. Customers want more. Accountants can no longer just have the technical skills and expect to scale. Rob Brown, in one of his podcasts, mentioned that specialized skills like Forensic Accounting, ESG, cybersecurity, capitalizing on the experiences, and tapping into the emerging landscape will be more needed if you want to gain an edge over your competitors, provide the best services to your clients, and scale.

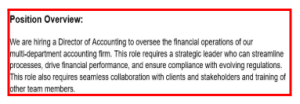

This is relevant when you are creating a niche business. Now, what happens when you are a firm that provides multiple services? You need someone who understands your business, someone who has the skills to put the best foot forward. That is where a role like Director of Accounting comes into the picture.

Now, you might think this is something that only bigger firms need. But that’s not the case. Even if you are a small accounting firm owner, it can get overwhelming to do it all on your own. So, instead of getting someone in-house and increasing the overhead costs, you might consider an offshore Director of Accounting.

What does a Director of Accounting role mean for an accounting firm?

A Director of Accounting isn’t just a senior title in your organizational hierarchy. Having this role within your organization means you can bridge financial accuracy, strategic insight, and operational leadership. A Directorial role in Accounting is critical in overseeing financial operations, ensuring compliance with regulations, and leading the accounting team to maintain integrity in the financial operations.

The Director of Accounting Role has become more important than ever. Data suggests that:

- About 70% of organizations have a dedicated Director of Finance. This number points towards the increasing complexity of financial management.

- The demand for such professionals is expected to grow by 6% between 2023 and 2033, as complex reporting requirements become more important.

Download Director of Accounting Job Description Template

The Director of Accounting Role is strategic, not just operational – WHY?

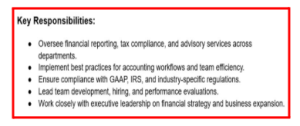

Unlike junior and mid-level accountants, a Director is not just responsible for ensuring that transactions are recorded correctly. Their job includes:

- Structuring financial operations across departments.

- Build and lead accounting teams that can scale as the business grows

- Design and enforce internal controls that protect the company.

- Partner with leadership on business planning, forecasting, and compliance.

Without a strong Director of Accounting or someone in a similar position, companies may struggle with late closures, audit issues, cash flow surprises, and financial and reputational damage.

Why do you need a thorough Job Description for such roles?

Hiring for a leadership role is often tricky. In case you end up with a wrong hire, the impact trickles down to the bottom. The teams can lose motivation, which can, in turn, lead to inefficiencies and unproductivity. An inaccurate or vague job description can have one or more of the following impacts:

- Attract underqualified candidates who aren’t ready to take on the challenges of the role

- Set the wrong performance expectations internally and externally

- Delay progress when, in fact, your company needs reliable financial direction

On the other hand, a clear and detailed job description ensures that you bring in a leader who knows what to expect, what success looks like, and how their role connects to the broader organizational goals.

Core Elements to Include in the Job Description of a Director of Accounting

Job Title: By mentioning the accurate job title, which will appear everywhere when they join, the candidates become aware of the responsibility and what is expected of them.

Role Summary: The role summary should be the answer when someone asks your “Director of Accounting” what they do.

Key Responsibilities: This section will delve deeper into what they do, specific deliverables, and all the things they will be accountable for.

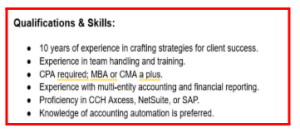

Required Skills & Tools: There are specialized skills and tools that a person hired in a leadership position requires. Giving them the entire picture will help them perform effectively from day 1.

KPIs or Success Metrics: Defines how success will be measured, leaving no room for confusion in performance reviews.

Company Overview: Aligns the individual’s responsibilities with broader company goals and values for mission-based accountability.

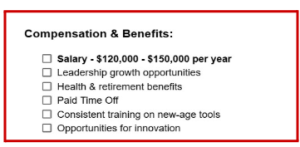

Compensation & Benefits: This is the parameter that candidates also look for first when they are joining. This section ensures goal alignment.

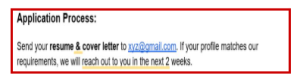

Application Process: Candidates trust firms better when they witness open and transparent communication. Letting them know the timelines will work in your favor.

DOWNLOAD THE FREE DIRECTOR OF ACCOUNTING JD TEMPLATES

Important KPI and Metrics that should be included in the JD

Being a strategic role, it can get difficult to track the performance of the Director of Accounting if you do not have proper parameters in place. This can confuse the candidate as well as the team when they come on board.

Sample KPIs could include:

- Days to close books after month-end: Target 5–7 days.

- Audit findings: Zero material weaknesses reported.

- Budget vs Actuals variance: Maintain accuracy within 2-5%.

- Team retention: Keep annual accounting team turnover below industry benchmarks.

- Implementation of automation initiatives: Complete projects on time and within budget.

How does a great JD, especially for niche roles, make hiring and onboarding smooth?

While this is relevant for any position you might be hiring for, it becomes especially important in senior and leadership positions. When candidates are clear on what is expected of them, they can get going. A clear JD helps:

- Attract candidates with the right blend of leadership and technical skills.

- Align internal hiring teams on what “good” looks like.

- Make onboarding more focused and efficient.

- Set clear initial performance goals.

- Establish a sense of ownership and accountability early on.

It saves time, reduces confusion and misalignment, and ultimately helps build a more cohesive leadership team in your finance department.

Need help filling the role?

Writing the perfect job description is only half the battle, but it can get tricky. These free Job Description templates can help.

But what about the next challenge of finding a skilled and qualified resource?

Finsmart Accounting’s team of pre-qualified, pre-vetted, English-speaking resources can help you deploy a Director of Accounting from day 1. But that is just the beginning.

A strong offshoring partnership means your extended teams blend seamlessly into your own. With our Embedded Outsourcing model, your new team members don’t just support your operations — they become an extension of your firm’s culture and goals from Day 1.

Here’s how we ensure a seamless start:

- The team gets a comprehensive understanding of your firm’s structure, workflows, and expectations.

- We collaborate to set up the right tech stack — accounting software, communication channels, document management, and time tracking — for smooth day-to-day operations.

- Our team dives deep into your accounting processes to align on priorities, timelines, and quality standards.

- Together, we customize the offshoring workflow using our proven 14-step implementation guide, ensuring clarity, accountability, and efficiency from the outset.

- We assign a Team Leader and an Account Manager who are responsible for your satisfaction and success.

When you partner with Finsmart, you don’t just fill a position — you unlock a scalable, high-performing accounting function built for long-term success.

Ready to experience the Finsmart difference? Let’s start the conversation today.

BOOK THE DIRECTOR OF ACCOUNTING JD TEMPLATE PACK TODAY

CONTENT DISCLAIMER

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Finsmart Accounting does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.

FINSMART SERVICES

![Accounts Receivable Manager Job Description: Responsibilities & Team Impact [+ Free Job Template]](https://finsmartaccounting.com/wp-content/uploads/2025/06/rsz_closeup-marketing-expert-using-calculator.jpg)