“Five years ago, I was one of those people that said, I would never offshore. I was like, Why would I hand over my clients financial information to you on the other side of the world? Why not hire somebody locally that I can groom and teach?

I didn't understand the outsourcing process.

Then I got to know the Finsmart Accounting team over the last three years. Seeing how the Finsmart team is run has eased many of my fears. Now I feel very secure getting them my client data to work on.”

—Patricia Hendrix, Head of Coaching and Communities at Woodard

As the accounting talent crunch bites harder, forward-thinking accounting firm owners, CPAs, and CFOs like are leveraging outsourcing to build their dream practice without hiring more, paying more, or managing more.

This article examines the types of services you can outsource today, the top firms to partner with and hot tips to make outsourced accounting services your (work)force multiplier.

What Are Outsourced Accounting Services? A Simple Definition!

Outsourcing a service is when CPAs, accounting firms, CPAs, CFOs, etc. delegate some or all of their accounting functions to a third-party accounting firm that specializes in this type of service.

This is usually done to ensure the same, if not better, quality of service for their clients or businesses.

These external accountants usually have years of relevant experience, which enables them to integrate into your existing accounting team and workflow with minimal training.

“Our outsourcing partner, The Finsmart Accounting team, already knows the accounting processes. That means I don't have to train somebody that's totally green like I had done in the past.

They were able to hit the ground running, so we were able to hold a meeting with the person assigned to our team and we walked through that client and what we need to do and what their business is about.

That way, they can apply the accounting knowledge, the QuickBook knowledge, the reconciliation knowledge and all that kind of stuff to the specific issues of that client. I don't have to show them how to do accounting.” —Rebecca Santiago, Owner, Advance Professional Accounting Service

Why Firms Are Increasingly Outsourcing

More accounting firm owners, CPAs and CFOs are realizing that they can get the most value out of their human resources when they delegate some of their work to an eager pool of accounting professionals in third-party companies.

Most notably, outsourcing these activities enables them to access experienced and versatile professionals at a fraction of the cost.

“I found myself in a very unique position where I was having a hard time finding the right fit for the right price.

I received notice from two of our part-time staff, and I needed to replace them with full-time positions. I could not find accounting talents with the right skills that were not priced outside our budget.” —Rebecca Santiago, Owner, Advance Professional Accounting Service

The Difference Between Outsourcing and Offshoring

The main difference between outsourcing and offshoring is location and ownership. Outsourcing allows you to delegate your business functions to an external firm that you neither own nor control.

In Offshoring, you hire employees overseas to meet your client demands so that you can enjoy lower production costs.

The Association of Certified Chartered Accountants (ACCA)acknowledges that offshoring also describes a situation where you contract (just like outsourcing) external accounting professionals to meet increasing client demands.

Top Benefits of Outsourced Accounting Services for Growing Firms

-

Access to Expertise: Outsourced accounting firms are built by (and with) professionals who have both formal and self-taught education.

While you may need to train them on your specific workflows and SOPs, they already know what is required to do monthly bookkeeping, manage payroll, and file taxes according to generally accepted (and country-specific) standards.

“I used to think offshoring outfits were like labor pools where anybody could come in off the street and be a bookkeeper, but that's not the case at all.

The knowledge and education standards of outsourcing and offshoring firms are higher than the average bookkeeper requirement in the United States.

Most of Finsmart’s staff are the equivalent of a CPA in the US. They've got a master's in accounting. A lot of bookkeepers that I work with in the US are self-taught and not necessarily trained as accountants.” —Patricia Hendrix, Head of Coaching and Communities at Woodard

-

Cost-Effectiveness: Outsourced accounting provides you the benefits of a full-time accounting professional without the salaries and employment benefits.

That’s why firms that outsource get to save as much as 62% of personnel costs.

-

Scalability: The services of an outsourced accounting firm are structured to grow with your business.

You can start with a once-in-a-month, quarter, or year project and add more services (or switch to a higher package) as your client demands increase.

-

Improved Accuracy and Compliance: Outsourcing firms like Finsmart Accounting offer full-stack accounting solutions.

They can handle every aspect of a client’s accounting needs, from bookkeeping, payroll, financial reporting and tax preparation.

This allows them to dedicate staff members to a client project, encouraging consistency and continuity, which can make the client’s tax projects more accurate and efficient.

8 Essential Accounting Services Commonly Outsourced

Most accounting services can be outsourced, but the following services lend themselves to outsourcing most easily:

-

Bookkeeping:Outsourcing bookkeeping projects allows accounting firms to devote their human resources to high-impact work like advisory and forecasting.

-

Payroll Processing: by delegating the time-consuming work of managing payroll to external accountants, you can ensure your client’s employees and vendors get paid without necessarily getting into the weeds every month.

-

Tax Planning and Preparation: you probably shouldn’t be filling all your client’s tax returns when you can spend that time helping with tax planning and resolution.

Outsourced tax preparers can do this at a fraction of the cost, so you can do more meaningful work during tax season.

-

Financial Reporting: Generating financial statements requires a series of steps that include gathering financial data, choosing the right reporting framework, preparing the financial data, and drafting management’s decisions and analysis (MDSA).

Outsourcing enables you to provide your outsourcing partner with the resources they need to make sure your client’s finances are accurately and completely reported.

-

Accounts Receivable and Accounts Payable Management: This is when CPAs, CFOs, etc delegate their invoice management and receivable collection work to their outsourcing partners.

-

Financial Analysis and Advisory: Accounting outsourcing firms can also help you make sense of your client’s financial data and create strategies to help them achieve their business goals.

-

Audit Support: CPAs outsourced audit services to leverage specialized audit expertise to keep their client’s finances ready for tax and regulatory scrutiny.

-

Software Implementation and Support: Outsourcing software implementation will ensure that your employees never have to worry about the challenges of using technology for their financial tasks.

Deep Dives into the Most Popular Outsourced Accounting Services

Outsourced Bookkeeping Services: What to Expect

Two key steps will help you get the most out of an outsourced bookkeeping service.

Those are:

-

Providing Relevant Access to Your Assigned Bookkeeper (s)

Once given the necessary access, your outsourced bookkeeper will get to work to make your client’s books impeccable.

That would include access to your client’s QuickBooks file, bank statements , expense management system, etc.

-

Designate a Contact Person

Some firms integrate their outsourced bookkeepers into their firms like their full-time staff.

If that doesn’t work for you, you may have to designate a staff member who will be a point of contact between your business and the outsourced bookkeeping team.

Accounts Payable (AP) Outsourcing: Important Details

As a CFO, transferring your accounts payables to an AP outsourcing firm will benefit your firm in terms of:

-

AP Accuracy: AP Outsourcing firms will likely pay more attention to invoice information to catch errors that could have led to duplicate payment.

-

Strengthen Controls of the AP Process: with experiences dealing with diverse accounts payable problems, AP outsourcing firms could help adjust your invoice approval workflow to ensure your firm pays vendors on time.

-

Prevent Problems with Suppliers: meeting your vendors’ expectations can improve your vendor relationships and prevent dissatisfaction that can make them terminate contracts.

Accounts Receivable Outsourcing: How it works

CFOs and Finance teams also rely on the receivable collection strategies of accounts receivable outsourcing firms to maintain positive cash flow.

Here’s how it works:

-

Generate Invoice

-

Once the job is complete, the business owner will generate the invoice and transfer the receivable collection process to the receivable outsourcing firm.

-

Receivable Work Moves to Outsourcing Partner

The outsourced receivable collection professional will take over the process, from contacting the customer's AP department to verifying receipt of the invoice and tracking invoice approval until payment is made and credited to your account.

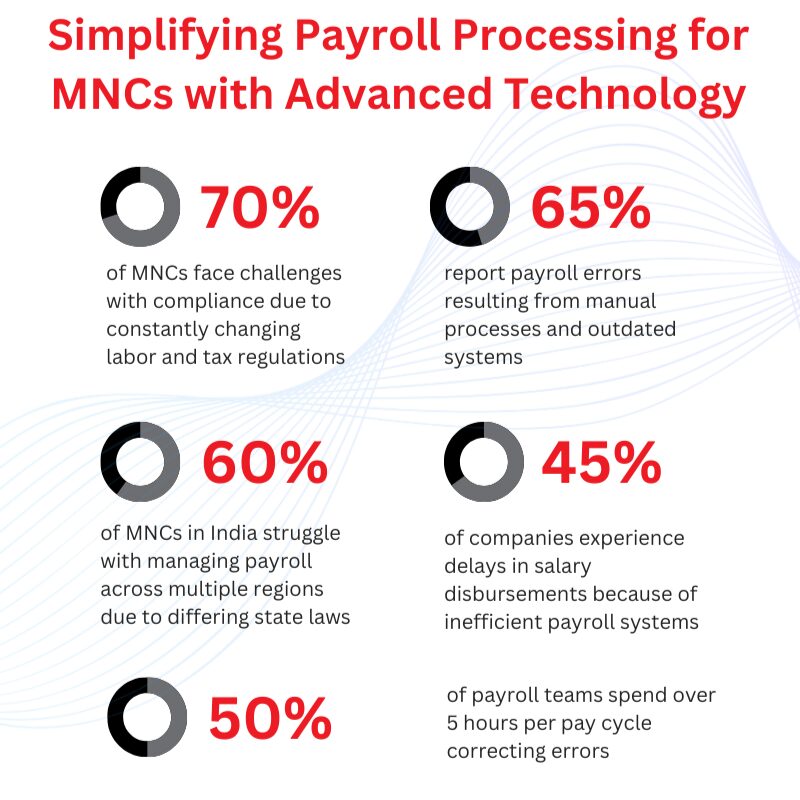

Outsourced Payroll Services: Benefits and Pitfalls

Every accounting professional has their favorite type of accounting work.

Unless you enjoy the challenges of payroll work, you will find it more frustrating to manage its complex requirements. Outsourcing your payroll projects enables you to provide this service to clients in an accurate, timely and confident manner.

The Pitfalls of Outsourced Payroll

Common challenges with outsourced payroll include:

-

Obtaining Unauthorized Access to Client Data: It’s easy (and risky) to forget to get your client’s consent before outsourcing their payroll work. While Your client might have trusted you with their employee information. It is not the same for your outsourcing partner, who they likely don’t know.

Be sure to obtain your client’s consent to outsource their payroll work and if they don’t approve, you will have to do the work yourself.

-

Responsibility for Your Partner’s Action: Despite obtaining your client’s consent to outsource their payroll projects, the responsibility for meeting the client deliverables rests with you. This might pose more risks to your credibility, seeing that you’re not totally in control of your outsourcing partner’s priorities.

Managed Payroll Services vs. In-House: Which Is Better?

Outsourcing the entire payroll process allows you to enjoy:

-

Versatility:

Having gained numerous experiences from working with numerous businesses, a managed payroll service provider will define your client’s vacation payment, termination obligations more effectively.

-

Convenience: It saves you the stress of doing the type of work you’re neither proud of nor very proficient at.

But In-House Payroll gives you more control over:

-

Over your client’s employee information: unless you can vouch for the security of your client’s data, using a third-party makes you liable for any compromise of your client’s data.

-

The payroll processing workflow: it can be easier for in-house payroll teams to collaborate with the client’s HR teams. Otherwise, the outsourced payroll expert will need to go through your in-house team to the client when they need more information, which might create a bottleneck in the process.

Outsourced Tax Preparation: What You Should Know

The true cost of doing all your client’s tax returns by yourself is the many other strategic work you can have done to move your practice to the next level.

Outsourcing your tax preparer work is about leaving low-impact work to focus on your expertise on projects that drive the most value for your firm.

When you delegate your tax filing to your outsourcing partners, your in-house team can devote their time and expertise on tax planning, resolution and consulting, which have higher profit margins.

Plus, reputable outsourcing firms are up-to-date with the ever-changing tax regulations. They can provide insights that improve the result of your tax work.

Two tips to make your outsourced tax work more successful

-

Maintain Transparency: by informing your clients about the third-party tax preparer. Your client should be assured that their work will maintain your quality standard.

Review every work delivered by your outsourcing partner to ensure their accuracy.

-

Use Vetted Companies: While making your independent research is important, also ask for recommendations in your professional network.

For example, when Rebecca Santiago needed to outsource some of her firm’s work, she took advice from Patricia Hendricks, the head of coaching and communities at Woodard, and that recommendation led her to a thriving relationship with Finsmart Accounting.

“ I was recommended to Finsmart Accounting by Patricia Hendricks at Woodard and that was a very great recommendation because I trust in their process of vetting Finsmart Accounting. That gave me a lot of confidence that we would probably have a good fit.” —Rebecca Santiago, Owner, Advance Professional Accounting Service

Outsourced Auditing Services: Enhancing Compliance

In outsourcing your audit services, you work with your partner to save your clients the financial and reputational losses associated with non-compliance.

This means:

-

Choosing Reputable Providers: by assessing their expertise, responsiveness and security measures.

-

Overseeing the Work: using tools like Financial Cents that give you visibility into the audit work through planning, fieldwork and reporting.

-

Keeping Clients Informed: Apart from informing the client about your plans to work with a vetted third-party accountant, you’ll be required to communicate the audit findings and any other findings during and after the audit work is done.

Financial Reporting Outsourcing: Cut Errors, Save Time

Speed and accuracy, two of the most important factors in financial reporting, are more achievable with outsourcing.

Reputable outsourcing firms have dedicated staff that monitor changes in the generally accepted accounting principles (GAAP) and international financial report standards (IFRS). They apply this knowledge to document and communicate your client’s financial performance over specific periods.

By keeping tabs with changes in the relevant reporting framework, outsourcing firms have a quicker turnaround time. The accuracy of the work also prevents the need for rework, which helps financial reporting projects to be completed faster.

With that, your client will not only comply with the relevant reporting standard, they will also access the information they need to improve their financial performance more quickly.

CPA Outsourcing: When and Why to Do It

Every now and then, you get swamped with client demands (like tax season and year-end closing) for which you may not want to hire a full-time CPA.

In that case, a full-time CPA may cost you 10s of thousands of dollars, but an outsourced CPA service will require you to pay for only the times you need them.

Employee turnover is another reason for CPA Outsourcing . If an employee quits, that leaves a vacancy that must be filled if you don’t want to lose your hard-won clients.

In this case, an Outsourced CPA firm can help you quickly fill these vacancies to help you deliver client projects as promised.

On the flip side, this means that your Outsourced CPA partner enables you to add more clients, knowing that you have enough capacity to manage a jump in your workload.

Real-World Examples of Accounting Outsourcing in Action

How Foray Business Group Found the Perfect Outsourcing Partner in Finsmart Accounting

Elizabeth Bergen is the owner of Foray Business Group, a bookkeeping firm that takes care of time-consuming financial management tasks for business owners.

As the firm grew, the internal team was under increasing pressure to meet more client deliverables than they realistically could. Being a proactive firm owner, Elizabeth did not wait for her firm to reach its breaking point to start searching for an outsourcing partner.

Although their first outsourcing partner was unsuitable to their work style, they used the lessons they learned from it to find a more suitable partner in Finsmart Accounting.

"The other overseas contractor we use had a massive turnover on a regular basis and I was having to explain and go over my SOPs with their new employees on a regular basis." —Elizabeth Bergen, owner of Foray Business Group

Finsmart has provided Foray Business Group with the stability and continuity they need to meet client deliverables consistently.

“Since working with Finsmart, we have had one main person that has been with us through the whole series of time, and she has continued to learn and develop when we've had to bring on additional projects,” said Elizabeth.

Speaking of the impact of the outsourcing relationship with Finsmart, Elizabeth said:

“One of the things my internal team appreciates is that Finsmart bookkeepers have integrated well into our team. We have regular meetings with them and my internal staff enjoy their efficiency and productivity. —Elizabeth Bergen, owner of Foray Business Group

From Overwhelmed to Empowered: How Corban Accounting Solutions Regained its Time to Grow the Business

Adrien Dove has run Corban Accounting Solutions as a solo practitioner since its establishment in 2018.

Like most firm owners, Addrienne wanted to capitalize on her exceptional services to add as many clients as possible.

However, with just 15 clients, she was already overworking, going seven (7) days a week and losing her work-life balance in the process.

“At around 15 clients, I completely ran out of capacity. I was working around the clock seven days a week. I ran out of time and space and the ability to take on more clients and grow.” —Adrienne Dove, Founder, Corban Accounting Solutions

With Finsmart Accounting, Adrienne has freed up her time to work on the business instead of working in the business.

In her words, “I'm now able to do more of an advisory, overseeing, and overview work as opposed to the back office operation of bookkeeping.”

How to Choose the Right Outsourced Accounting Services Partner

Before you get into an outsourcing relationship with a firm, the answer to the questions below. While at it, watch out for the following red flags to save your team from troubles with the wrong outsourcing relationships.

Three Key Questions to Ask

-

Do they have relevant knowledge of the tax law and financial reporting requirements?

Tax systems and regulations differ from country to country. Within the US alone, the application of the federal tax law varies from state to state.

Be sure that your outsourcing partners are proficient in your specific accounting needs, so you don’t have to train them from scratch.

-

Are they experienced with your niche?

The more experienced they are in your industry, the more likely they’ll be to fit into your existing workflows and deliver value quickly.

-

Which team member will be assigned to your account?

This question will help you understand the qualifications and experience level of the specific team member(s) your outsourcing partner will assign to your firm.

Four Red Flags to Avoid

-

Lack of Transparency: Lack of transparency will create too many blind spots in the working relationship.

You’d want to be able to provide timely client updates, but your ability to do that depends on what you know about the project.

Again, workflow tools like Financial Cents makes it easy to see where each of your client work stands in real time.

-

Poor Communication: If you have to jump through hoops to communicate with your outsourcing partner, that may not help your efficiency in the long term.

You’d want your partner to be responsive and put your financial concerns to bed in a timely and effective manner.

“My communication with the Finsmart team has been tremendous. I feel like there is not a time zone difference. There’s no delay in transferring information. The external contractors I used in the past had me meet them at the start of their day, and that was my 9 or 10:00 PM. It was difficult for me.” —Elizabeth Bergen, owner of Foray Business Group

-

High Employee Turnover: If your potential outsourcing partner’s employees leave too frequently, you will have to explain your processes to the new staff frequently, which would strain your time and productive energy.

-

Inexperienced Staff: Access to accounting expertise is a major benefit of outsourcing. If the person assigned to your firm is inexperienced, there may be more errors and rework than you can bear.

Two Contract and Data Security Tips

Data security is a primary concern in outsourcing, and rightly so. Use these tips to ensure your data will be safe with your outsourced accounting partner.

-

Access Control: Business owners can control what an outsourced bookkeeper can do with their financial information by working with their bank to give them read-only login information.

For accounting firms, Kenji Kuramoto, the Founder & CEO of Acuity, suggests using accounting software solutions that provide necessary security checks.

“Leverage the security of your tech partners. Our team is working with tools from Intuit, Xero, or Google Suite. This enables us to control the information our outsourcing partners can access, and the user permissions allow us to regulate what actions they can take.” —Kenji Kuramoto (Founder & CEO, Acuity

-

Use Confidentiality Agreements: this agreement will prevent your staff members from sharing sensitive information.

Top Outsourced Accounting Services Firms to Consider in 2025

-

Finsmart Accounting

Finsmart provides all accounting and bookkeeping services, including tax, payroll, and AP/AR services to growth-minded enterprises.

Since 2007, the firm’s team of accounting professionals has used its domain expertise to provide global enterprises, multinational corporations, and CPA firms:

- Plug-n-Play accounting resources

- Subscription model that does not require long-term contracts

- Embedded Offshoring (when you need professionals to work within your systems like your in-house staff).

Pricing Its prices are

Dedicated Seat: $2600/month for:

- Dedicated Resource

- 160 hours per month

- Updates to Book of Account

- Bank and Credit Card Reconciliation

- Monthly Closing of Books of Accounts

- Weekly 30 minutes

- Email Support Unlimited

Hourly Seat: $20 per hour

- Updates to Book of Accounts

- Bank and Credit Card Reconciliation

- Monthly Closing of Books of Accounts

- Weekly 30 minutes

- Email Support Limited to 3 emails per week

-

TOA Global

TOA Global provides accounting and bookkeeping talents that help international companies unlock their potential, using outsourcing professionals from the Philippines.

Since 2014, the TOA Global team has used its Filipino team to serve over 1,000 accounting and bookkeeping firms worldwide.

Pricing

Contact the TOA Global team to get your quote tailored to your accounting needs.

-

Indinero

Indinero considers itself a team of innovators, problem solvers, and growth enablers for accounting businesses.

The team leverages inclusivity and effective collaboration to help their clients access accounting insights that drive growth and decision-making.

Pricing

- Essential: $ 750 per month. This is ideal for small businesses that need simple and effective financial structures, processes, and statements.

- Growth: $ 1250 per month this is more suitable for established businesses and companies looking to grow their business. This package covers accrual accounting, BBO, or NetSuite setup.

- Executive: Custom package

-

Mindspace Outsourcing Services Pvt Limited

Mindspace outsourcing uses technology to provide business owners with modern accounting solutions that streamline their financial reporting process.

With a special emphasis on effective communication, Mindspace seeks to share every bit of information to give you more control over your financial data.

Pricing

Get in touch with the Mindspace team to understand the cost of accessing their service for your specific needs.

-

Booth and Partners

Booth and Partners uses accounting professionals from Colombia and the Philippines to take on some or all of a company's accounting tasks to help its employees focus on their core competencies.

As an extension of your team, Booth and Partner’s work frees up your time, enabling you to build your business faster, satisfy customers easily, and take your business to the next level.

Pricing:

Contact the Booth and Partners team for a quote based on your accounting needs.

Two Expert Tips for Getting the Most Out of Outsourced Accounting

-

Check for Data Security Protocols

Maanoj Shah, Fismart Accounting’s Co-Founder recommends understanding what your potential partner is doing to secure your client’s data.

Maanoj said, “When evaluating a potential partner, ask for their certifications. Reputable outsourcing or offshoring firms have specialized offshoring centers with several security protocols.

“In terms of data security, a reputable outsourcing firm should have protected servers, managed switches, and antiviruses. —Maanoj Shah, Co-Founder and Director of Growth and Alliances at Finsmart Accounting

They should also have certifications like ISO, SOC II, etc. These security measures will enable them to protect your client’s data.”

-

Make Data Available to Your Outsourced Accountants Faster

If your outsourced accounting professional has to chase you for the information they need to complete your work each month, they’ll lose the time they’d have used to get the job done. This will cause unnecessary delays and missed deadlines.

Using a modern practice management solution will help you centralize work information for your employees (full-time or outsourced) to use for work on the go.

Is Outsourcing Right for Your Firm?

Going by the reports of notable accounting associations like the AICPA , the shortage of accounting talents might worsen in the coming years.

If you’re already struggling to find qualified talents to meet client demands, this might be your sign to consider outsourced accounting services.

While you’re making up your mind, use our outsourcing readiness checklist to understand the systems you can start putting in place for outsourcing success.

To understand how outsourcing can benefit your specific needs, select a time here to book a Free Consultation session with us today .

Maanoj is Co-founder & Director of Growth Strategy & Alliance at Finsmart Accounting. He is an Outsourcing Expert, a People Champion, and a Dynamic Leader with strong Business Strategy and Scaling-up experience. He has incubated businesses, sold & exited ventures; helped build strong enterprises in very diversified verticals like Fintech, HR & Consulting spaces in various CXO capacities over the last 20 years.